July 25, 2017

Unless you’re an insurance agent or work in the industry, insurance terminology can seem confusing or full of jargon. Your experience modification rate, also known as an e-mod, EMR, or experience modifier, is a good example. Put simply, your e-mod represents the workplace safety record, but there is a lot that goes into calculating it.

We discussed e-mods, how they are calculated, how they affect your premium, and what they mean for your business in our July webinar. These monthly webinars are one of the ways we cut through insurance industry jargon to help you understand workers’ compensation. They take place on the first Friday of every month. Watch the presentation and see what you can do to keep control your e-mod, or read on for our key takeaways.

What is an e-mod and what is its purpose?

An e-mod is a numerical factor that reflects a company’s historical cost of injuries and future risks. It is used to calculate premium.

E-mods serve two main purposes. The first is for comparative analysis. An e-mod reflects the past loss experience of a company compared against other employers in the same industry. This comparison generates the e-mod, which is used to adjust the workers’ compensation premium up or down. The second purpose is to create incentive in the workplace for employers to maintain a safe work environment by preventing hazards and properly training employees.

Loss experience is a more reliable predictor of future losses for larger premium, so we do not apply an e-mod to employers who have less than $5,000 in premium.

It’s important to keep in mind, though, that while e-mods are used to calculate premium, they aren’t a great measure of how safe a company actually is. We explain this in greater detail in 10 Reasons to Stop Using E-mods to Evaluate Safety.

How your e-mod is calculated

An e-mod compares an employer’s actual losses (experience rating) against the expected losses for their industry as a whole. To determine your company’s expected losses, your company’s payroll and class codes are taken into consideration. A simple explanation of how your e-mod is calculated is actual losses divided by expected losses for the industry.

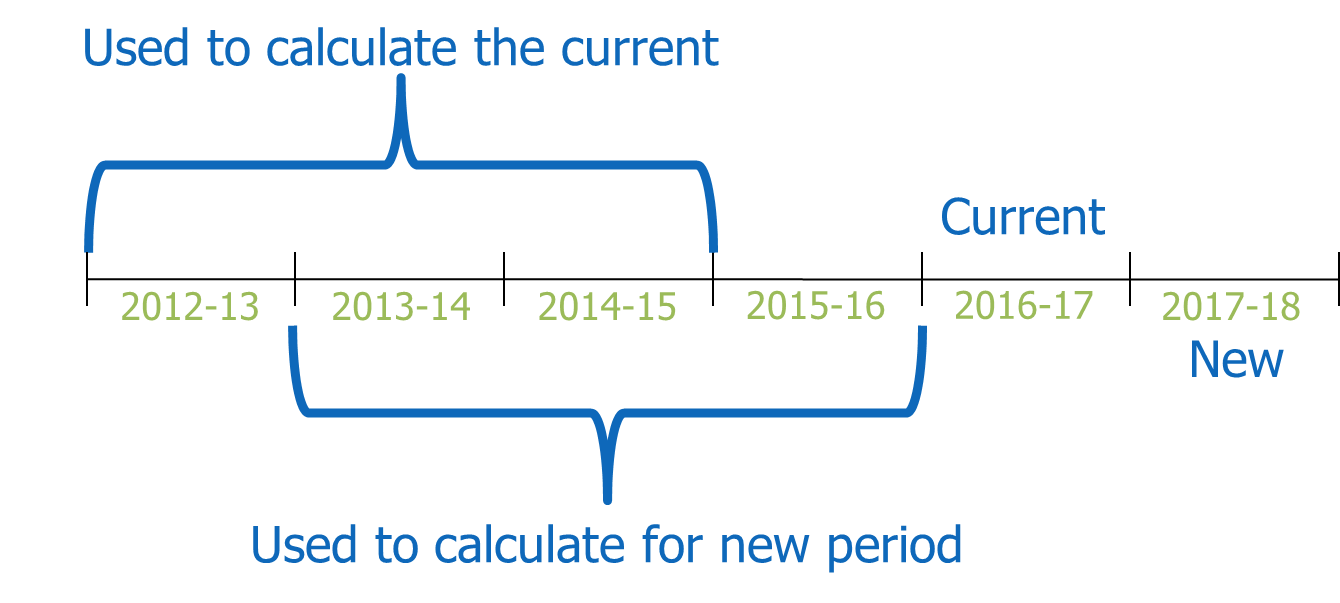

Your current e-mod takes into account claims data from the most recent three-year period. The image below is a representation of how your losses can affect your e-mod and illustrates how losses can fall outside the three-year window. Because three full years of data is needed to determine your e-mod, losses don’t immediately affect it and they eventually drop off.

How your e-mod affects your premium

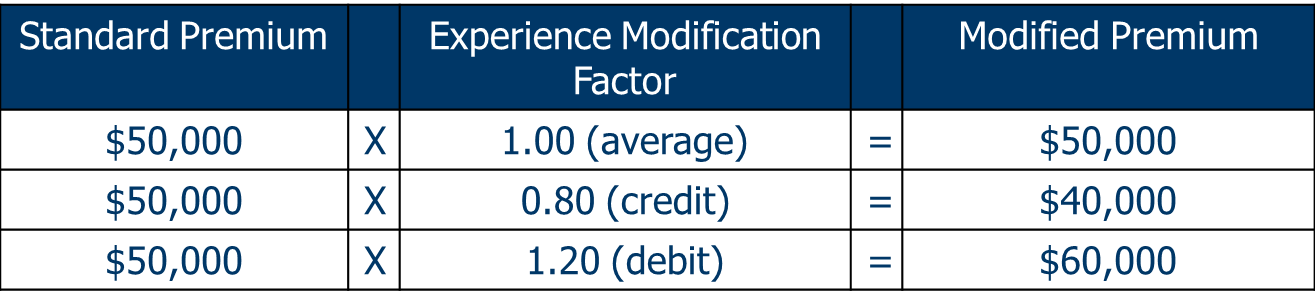

E-mod ratings are determined by the National Council on Compensation Insurance (NCCI). Most states, including Texas, use the NCCI to calculate experience modifiers. A score of 1.0 represents an average risk and means the company should perform as expected for the industry. A multiplier of less than 1.00 is a credit mod and indicates a company is safer than average within its industry. A multiplier greater than 1.00 is a debit mod and indicates a company that is less safe than average. The chart below shows examples of how your experience modification factor can affect your premium.

What you can do to control your e-mod

Although accidents happen, there are steps you can take to keep your e-mod under control. Encouraging safe practices in your workplace and implementing return-to-work programs can help. Read our tips below:

- Create a culture of safety. A positive safety culture starts at the top.

- Report injuries early. Allow adjusters and doctors to address the injury as soon as possible. This helps to ensure the injured worker gets the necessary medical attention, so that an injury doesn’t become more serious.

- Implement an injury and illness program. Visit the safety resource center in your Texas Mutual Online account to take a safety program assessment. You’ll answer a few questions about your company’s operations and potential hazards, and receive a sample safety program.

- Train employees on safety topics. Provide a new employee orientation, refresher training, and remedial training as needed. Our safety resource center offers 2,000 free resources, including more than 200 e-Learning online training modules. Make sure to keep safety training records for OSHA reporting.

- Investigate accidents and near misses. Accident investigations can prevent safety incidents from occurring again.

If you still have questions about e-mods

We encourage you to talk to your agent, utilize NCCI resources, or view our recent blog on experience modifiers from our Your Claims Questions Answered video series.